Drop down menus are available for easy data entry in these fields (Type, Category, SubCategory, Account).Īfter you enter your transactions, the Transactions worksheet would look like this image below.Examples of Transfers are Credit Card Payment (transfer from Bank account to Credit Card account) and ATM withdrawal (transfer from Bank account to Cash).‘Transfer’ type with positive amount for the account you are depositing the money into.‘Transfer’ type with negative amount from the account you are taking the money from.Transfer: When money is transferred from one account to another, create two records.You need a level of financial awareness that perhaps even Paul Krugman doesn't possess. True, a spreadsheet is not as sexy as automated money-tracking. It also gives me more control than using a web-based site like Mint. Money Management Template When you've got a mortgage, children, a car payment, and other expenses to keep track of, it's hard to balance the budget and avoid overspending. For me, the more old-school hands-on approach is the only way to go I use my own custom-designed Excel spreadsheet because it forces me to actively manage my personal finances. If, a few days later, you returned the item to the store for some reason and get a refund, then you should enter the refund as a new Expense transaction with negative value. Here are 15 of their best financial spreadsheets.

#Best spreadsheets for personal finance free

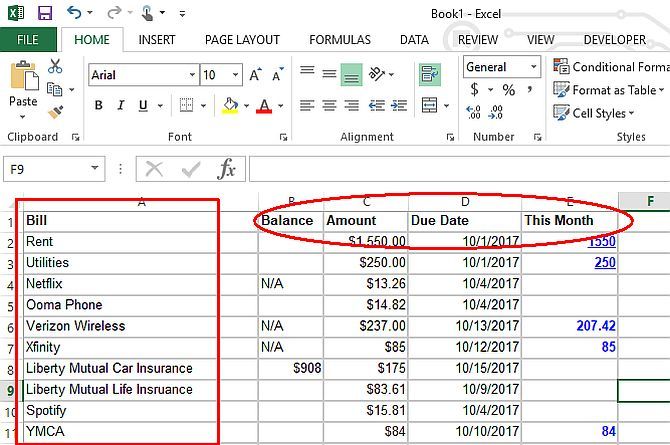

This is a simple free Personal Finance management excel template that focuses on making it easy for you to know what’s happening with your financial situation especially when you have multiple bank accounts, credit card accounts and cash. Personal Finance Manager 2021 (Free Excel Budget template)

0 kommentar(er)

0 kommentar(er)